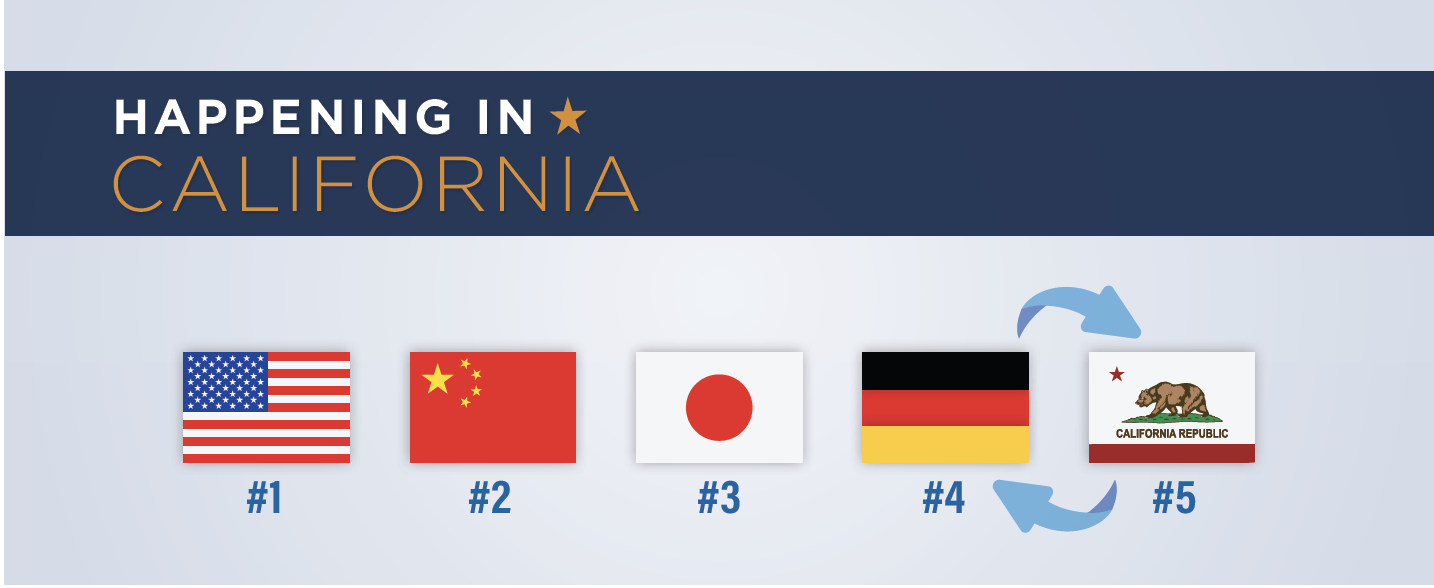

v 31.30 | California Poised to Overtake Germany

Welcome to Happening in California, a brief look at political news, insights, and analysis of the world’s fifth-largest economy.

Is California poised to overtake Germany and become the world’s fourth largest economy? That’s the prediction of a Bloomberg opinion piece that was touted by Governor Newsom before his re-election last November.

While it’s yet to be determined whether we’ll need to update the tagline of this newsletter, we do know that the Midterm election results were a goldmine for local governments in the Golden State.

Here is that story and how it could impact California’s ranking among world economies ...

Cheers,

Tom Ross | President and CEO | Swing Strategies

P.S. Please feel free to forward this email along to friends and encourage them to sign up here.

The Big Picture: The Local Tax Burden in California is Skyrocketing

Despite a two-thirds supermajority in the Legislature, Democrats in the state capitol have been reluctant to impose large tax increases. However, it is not uncommon to see statewide ballot measures each election cycle that aim to raise taxes.

In 2020, there was Prop 15, a $11.5 billion property tax increase that we helped to defeat. And this past cycle had the Lyft-sponsored Prop 30, a $5 billion income tax increase that voters also rejected.

While tax increases on the statewide ballot get all of the attention, local tax increases have proliferated and their aggregate effect on the tax burden of Californians is significant.

California voters approved a total of 1,447 local tax and bond measures out of 1,886 that were on the ballot in the past decade according to CaliforniaCityFinance.com. That’s a 75% passing rate, which is better than the 63% pass rate of statewide tax and bond ballot measures.

It makes sense that voters are more willing to stomach local tax hikes and bonds that are often used to address issues related to public safety, transportation, homelessness, and education. Voters feel more control and believe they’ll see tangible results from taxes at a local level. And perhaps most importantly, there is less organized opposition at the local level to fight these measures.

However, regardless of the merits of the local tax and bond measures, they are a considerable contributor to the high taxes Californians pay. Just look at the massive growth of local governments revenue in the last ten years ...

California’s 482 cities, 57 stand-alone counties, and 4,800 special districts make up the bulk of local government revenue. Here is the breakdown of their revenue in 2021:

$96 Billion in total city tax revenue (a 48% increase since 2011)

$107 Billion in total county tax revenue (a 88% increase since 2011)

$79 Billion in total special district tax revenue (a 130% increase since 2011)

(Source: California State Controller; the City/County of San Francisco is grouped with cities)

California’s city, county, and special district tax revenue totaled $282 billion in 2021 — increasing 80% in the past decade due in large part to higher taxes and bonds at the local level. For comparison, California’s state general fund revenues in 2023 are only $210 billion — $72 billion less than local government revenue.

It would be one thing if Californians were receiving quality services for all the local taxes they pay, but in many cases, from underperforming schools to the worsening homelessness crisis, local governments are falling behind.

The Bottom Line: California has the highest state sales tax, highest personal income tax, and highest gasoline tax in the nation, along with the seventh highest corporate income tax. This alone has been an area of contention resulting in businesses leaving the state.

Now factor in the skyrocketing local government taxes and it will be increasingly difficult for California to attract new businesses and investment — ultimately impacting the Golden State’s ranking among world economies.