Welcome to Happening in California, a brief look at political news, insights, and analysis of the world’s fifth-largest economy.

California’s finances are best described as a roller coaster.

Just this past May, California’s budget surplus soared to $97.5 billion and the governor’s spending plan topped $300 billion.

Now just two months later, the state’s fiscal analyst is warning that tax collections may be as much as $26 billion below projections.

Here is a quick refresher on California’s volatile tax revenue and why it matters …

Cheers,

Tom Ross | President and CEO | Swing Strategies

P.S. Share this page using the social icons on the page. Also you can share the link of this page and encourage friends to sign up using the form at the bottom of this page.

The Big Picture: California is facing the possibility of a steep drop in tax revenue as the economy slows.

In the past 10 years, California’s budget has doubled, buoyed up by taxable capital gains from Silicon Valley unicorns and record IPOs including Facebook, Uber, and Tesla.

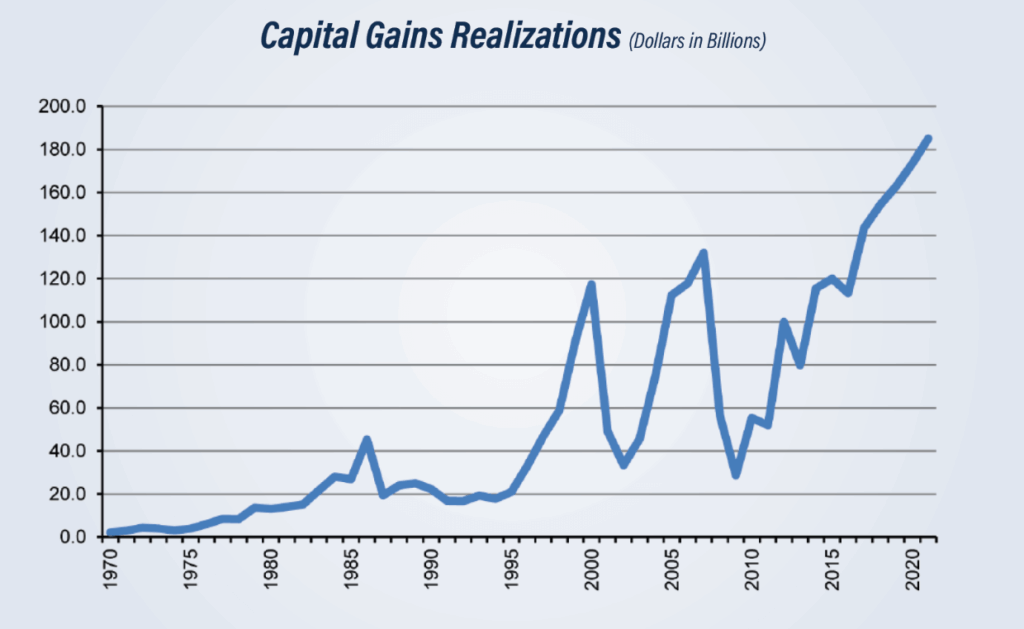

But as we saw following the dot-com crash in 2000 and the Great Recession in 2008, tax revenue from capital gains collapsed by 61% and 58% respectively. The results back then were budget deficits that were greater than the entire budgets of most states.

Should today’s economic downturn deepen, California’s budget deficits may be even more painful than before …

California’s General Fund revenue is primarily generated by the big three:

Of those, the biggest hunk of tax dollars by far comes from PIT, which happens to be the most volatile.

PIT is made up of Wages and Salaries, Capital Gains, Retirement Income, Business Income, Dividends, and Interest and Rent.

While Wages and Salaries makes up about 68% of PIT revenue, the percentage of PIT revenue generated from Capital Gains has nearly tripled since 2009.

The bulk of PIT revenue growth has come from high-income taxpayers — specifically high-income earners in the Bay Area.

Nearly 40% of PIT revenue comes from the Bay Area, which only makes up 20% of the population. Versus Los Angeles and Orange County which hold 36% of the state’s population and pay 34% of PIT revenue.

California’s tax revenue is highly reliant on economic growth in the Bay Area, but the recession poses a huge risk; in addition to the worsening tax, regulatory, legal, and political climate faced by the state’s technology companies (more on this later).

The Bottom Line: If the economy continues to falter, California may soon face record budget deficits.

And as California’s constitutional funding obligations lock in guaranteed spending increases — primarily K-14 education — it will be more difficult for the legislature to close budget holes without borrowing.

P.S. If you missed Swing Strategies’ California Ballot Initiative webinar last week, you have one more chance for an in-depth briefing on California’s seven propositions on the November ballot. Register today for the briefing which will be held on Wednesday, August 10 @ 12:00 pm.

A one-page summary of California’s 2022 statewide propositions.